INSTITUTE FOR ENERGY

Wind Energy in Pennsylvania

INTRODUCTION

Wind Energy in Pennsylvania

The power of the wind has been used for thousands of years. It helped early explorers to sail the oceans and navigate the world while windmills allowed for the pumping of water and grinding of grain. Today, wind energy is primarily harvested by wind turbines to generate electricity. Explore the page below to learn about wind in Pennsylvania, how to determine your wind resource, and find answers to your questions about small and utility-scale wind turbines.

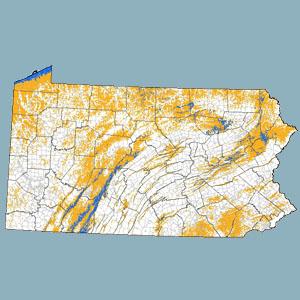

PA Wind Maps

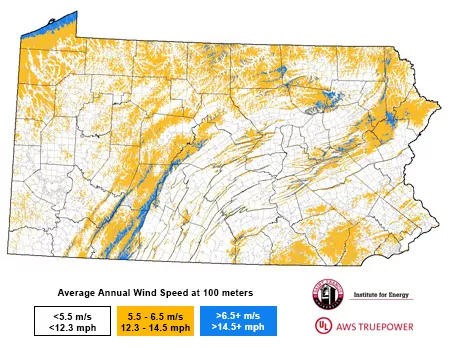

No matter where you go, the wind blows, but in some places, it can be predicted to occur at higher speeds than others. In Pennsylvania, these favorable areas include the shoreline of Lake Erie as well as the numerous ridgetops of the Commonwealth (depicted in blue on the accompanying map). The strongest resource is generally found high off the ground and away from turbulence-producing obstacles, like trees and buildings.

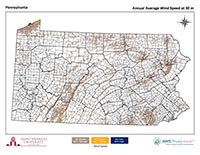

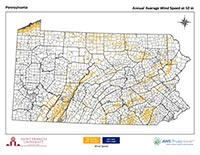

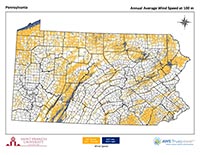

Assess Your Wind Energy Resource

Understanding your wind energy resource is critical to developing a successful project. Wind speeds vary throughout the day and throughout the year, so the following maps provide a summary that can help you to characterize the resource at your site. It is typically recommended that a small wind turbine be placed in a 10 mph (4.5 m/s) or greater average annual wind speed. Reference our 30-meter maps above surface level for small wind projects. Most utility-scale wind turbines in PA (to date) have been sited in locations with average annual wind speeds of 14.5 mph (6.5 m/s) or greater, although sites with wind speeds of 12 mph to 14 mph may be viable under certain conditions with the use of newer technologies. Reference our 100-meter maps above surface level for utility-scale projects.

Wind projects in areas with low wind speeds are generally not profitable. This does not mean they are impossible, but it does mean your motivation must be more than financial for the project to be worthwhile.

If you find that your site has a feasible resource, see our FAQs for further considerations.

If you find that wind is not suitable at your location, do not fret, consider some alternatives!

Pennsylvania State & County Wind Maps

Identify the expected annual average wind speed at a given height and location with our county and state wind maps. Review the map key then select a tab. Click an 'X' to view the map image.

Map Key

When siting a wind turbine, finding a strong resource to place it in is one of the key factors to a financially successful project.

Small Wind Example: If you are looking to install a small wind turbine, reference the 30-meter map (about 98.4 feet above the surface) for your location. A project placed in an area that is tan, orange, or blue-colored (expected to have a 10+ mph annual average wind speed) would be predicted to perform better than a turbine placed elsewhere. Locations exhibiting wind speeds above 10 mph at 30 meters high are fairly limited in Pennsylvania.

30 Meter Wind Map

100-Meter Wind Map

Utility Wind Example:

Developers and others seeking to place utility-scale turbines would reference the 100-meter (328 feet) map (some turbines now reach much higher than this). The resource in the blue areas (14.5 mph or stronger), would be expected to have the most suitable resource, on average. Some orange areas may also hold potential.

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site has a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. Refer to our tips in the FAQ section for additional suggestions.

Expected Wind Resource Example

The average annual resource would be expected to be:

Point A (blue) - 14.5 mph or higher (6.5 m/s or higher)

Point B (orange) - 12.3 to 14.5 mph (5.5-6.5 m/s)

Point C (tan) - 10.1 to 12.3 mph (4.5-5.5 m/s)

Point D (no color) - 10.1 mph or lower (4.5 m/s or lower)

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. Refer to our tips in the FAQ section for additional suggestions.

Adams - Centre

| County | 30m | 50m | 100m |

|---|---|---|---|

| Adams | X | X | X |

| Allegheny | X | X | X |

| Armstrong | X | X | X |

| Beaver | X | X | X |

| Bedford | X | X | X |

| Berks | X | X | X |

| Blair | X | X | X |

| Bradford | X | X | X |

| Bucks | X | X | X |

| Butler | X | X | X |

| Cambria | X | X | X |

| Cameron | X | X | X |

| Carbon | X | X | X |

| Centre - East | X | X | X |

| Centre - West | X | X | X |

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. See our tips below for additional suggestions.

Chester - Fulton

| County | 30m | 50m | 100m |

|---|---|---|---|

| Chester | X | X | X |

| Clarion | X | X | X |

| Clearfield | X | X | X |

| Clinton | X | X | X |

| Columbia | X | X | X |

| Crawford | X | X | X |

| Cumberland | X | X | X |

| Dauphin | X | X | X |

| Delaware | X | X | X |

| Elk | X | X | X |

| Erie | X | X | X |

| Fayette | X | X | X |

| Forest | X | X | X |

| Franklin | X | X | X |

| Fulton | X | X | X |

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. See our tips below for additional suggestions.

Greene - Mercer

| County | 30m | 50m | 100m |

|---|---|---|---|

| Greene | X | X | X |

| Huntingdon | X | X | X |

| Indiana | X | X | X |

| Jefferson | X | X | X |

| Juniata | X | X | X |

| Lackawanna | X | X | X |

| Lancaster | X | X | X |

| Lawrence | X | X | X |

| Lebanon | X | X | X |

| Lehigh | X | X | X |

| Luzerne | X | X | X |

| Lycoming East | X | X | X |

| Lycoming West | X | X | X |

| McKean | X | X | X |

| Mercer | X | X | X |

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. See our tips below for additional suggestions.

Mifflin - Susquehanna

| County | 30m | 50m | 100m |

|---|---|---|---|

| Mifflin | X | X | X |

| Monroe | X | X | X |

| Montgomery | X | X | X |

| Montour | X | X | X |

| Northampton | X | X | X |

| Northumberland | X | X | X |

| Perry | X | X | X |

| Philadelphia | X | X | X |

| Pike | X | X | X |

| Potter | X | X | X |

| Schuylkill | X | X | X |

| Snyder | X | X | X |

| Somerset | X | X | X |

| Sullivan | X | X | X |

| Susquehanna | X | X | X |

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. See our tips below for additional suggestions.

Tioga - York

| County | 30m | 50m | 100m |

|---|---|---|---|

| Tioga | X | X | X |

| Union | X | X | X |

| Venango | X | X | X |

| Warren | X | X | X |

| Washington | X | X | X |

| Wayne | X | X | X |

| Westmoreland East | X | X | X |

| Westmoreland West | X | X | X |

| Wyoming | X | X | X |

| York | X | X | X |

Note: All wind mapping is an approximated value calculated through complex formulas and correlations. Every site is unique. If you find your site to have a reasonable resource, we highly recommend having an installer make an on-site visit before you start a project to ensure there are no major issues. See our tips below for additional suggestions.

Was this information useful?

Pennsylvania Wind Farms

As of fall 2024, Pennsylvania was home to 27 utility-scale wind farms, all located in the southwest-central or northeastern areas of the state. The smallest wind farm, consisting of two turbines, is an exception, as it is in southeast PA at Turkey Point in Lancaster County. The Mehoopany Wind Farm in Wyoming County is Pennsylvania's largest wind farm (both in terms of wind turbines: 88 and capacity: 140.8 megawatts [abbreviated MW]). Somerset County is currently home to the most active wind farms (8) and the most wind turbines (198). The Sandy Ridge 2 Wind Farm, which “achieved full commercial operations” in September 2023, is the commonwealth’s newest wind farm. The Rogue Wind Farm in Cambria and Clearfield counties is anticipated to be completed in 2026.

Please note that the U.S. Department of Energy’s Wind Energy Technologies Office reported a decrease of 1.8 MW in capacity in PA between 2020 and 2022 that is not reflected in this data. The number of farms, turbines, and capacities is likely to fluctuate as many of Pennsylvania’s older wind farms are “repowered.” Repowering is the refurbishment or replacement of older wind turbines with newer, more efficient equipment.

Collectively, PA’s wind farms generated 3,258,324,000 kWh of electricity in 2023, enough to power more than 340,000 PA households (the average annual household consumption in PA in 2023 was 9,492 kWh), based on U.S. EIA statistics.

Learn more about the state's wind farms in the tabs and table below. Note: Wind farms are listed chronologically by when they were originally constructed. Megawatt is abbreviated MW in the table.

Active Wind Farms

| Wind Farm | County | Number of Turbines | Turbine Capacity (MW) | Farm Capacity (MW) |

| Somerset | Somerset | 6 | 1.5 | 9.0 |

| Mill Run | Fayette | 10 | 1.5 | 15.0 |

| Waymart | Wayne | 43 | 1.5 | 64.5 |

| Meyersdale | Somerset | 20 | 1.5 | 30.0 |

| Bear Creek | Luzerne | 12 | 2.0 | 24.0 |

| Locust Ridge I | Schuylkill | 13 | 2.0 | 26.0 |

| Allegheny Ridge | Cambria, Blair | 40 | 2.0 | 80.0 |

| Casselman | Somerset | 23 | 1.5 | 34.5 |

| Forward | Somerset | 14 | 2.1 | 29.4 |

| Lookout | Somerset | 18 | 2.1 | 37.8 |

| Locust Ridge II | Columbia, Schuylkill | 51 | 2.0 | 102.0 |

| Cambria (Highland) | Cambria | 25 | 2.5 | 62.5 |

| North Allegheny* | Cambria, Blair | 33 | 2.2 | 72.6 |

| Armenia Mountain | Tioga, Bradford | 67 | 1.5 | 100.5 |

| Stony Creek | Somerset | 35 | 1.5 | 52.5 |

| Chestnut Flats | Blair | 19 | 2.0 | 38.0 |

| South Chestnut | Fayette | 23 | 2.0 | 46.0 |

| Turkey Point Wind Project (Frey Farm Wind) | Lancaster | 2 | 1.6 | 3.2 |

| Highland North | Cambria | 30 | 2.5 | 75.0 |

| Sandy Ridge | Blair, Centre | 25 | 2.0 | 50.0 |

| Twin Ridges* | Somerset | 68 | 2.05 | 139.4 |

| Laurel Hill | Lycoming | 30 | 2.3 | 69.0 |

| Patton | Cambria | 15 | 2.0 | 30.0 |

| Mehoopany | Wyoming | 88 | 1.6 | 140.8 |

| Ringer Hill | Somerset | 14 | 2.85 | 39.9 |

| Big Level | Potter | 25 | 3.6 | 90.0 |

| Sandy Ridge2 | Blair, Centre | 15 | 6.0 (14x), 3.6 (1x) | 87.6 |

| Total | 764 | 1549.2 |

Projects that have been or are in the process of being repowered are listed with an *.

Under Construction Wind Farms

Wind Farm | County | Number of Turbines | Turbine Capacity (MW) | Farm Capacity (MW) |

Rogue's Wind | Cambria, Clearfield | 19 | 6 | 114 |

Repowered Wind Farms

Several of Pennsylvania's wind farms have been upgraded. The following statistics are for the original wind farms. See the Active Wind Farms tab for current statistics about the turbines that replaced the turbines listed here.

| Wind Farm | County | Number of Turbines | Turbine Capacity (MW) | Farm Capacity (MW) |

| North Allegheny (2009-2023) | Cambria, Blair | 35 | 2.0 | 70.0 |

| Twin Ridges (2012-2024) | Somerset | 68 | 2.05 | 139.4 |

The Highland North and Cambria (Highland) wind farms are scheduled to be repowered in late 2025 to early 2026, according to a press release from turbine manufacturer Vestas.

Deactivated Wind Farms

| Wind Farm | County | Number of Turbines | Turbine Capacity (MW) | Farm Capacity (MW) |

| Green Mountain Wind Energy Center* | Somerset | (8) removed | (1.3) | (10.4) deactivated |

*The Green Mountain Wind Energy Center was built in 2000, deactivated in 2015 and removed 2016, according to NextEra and the Johnstown Tribune-Democrat.

Was this information useful?

Wind Energy FAQs & Resources

Have a question? Find the answer here. Don't see your question?

Let Us Know: energy@francis.edu

Starting a Project

-

In Pennsylvania, the best wind resource is typically found at higher elevations and along the shore of Lake Erie. For a small wind project to be successful, a site's annual average wind speed should be no less than 10 - 12 miles per hour and the turbine should be positioned at least 30 feet above any obstacles that are within 500 feet. For larger turbines, a 6.5 + meters per second wind speed is typically needed to support a viable project. You can put a wind turbine just about anywhere and it will generate electricity. . .the question is how much and if the result satisfies your financial goals and other desired results. To help assess your wind resource, see our wind maps above.

Wind speed is a critical feature of the wind resource because the available energy in the wind is proportional to the cube of the wind speed. This means that by doubling the wind speed we do not double the power in the wind but get eight times the power. So, a site with an average wind speed of 15 mph has the potential to contain eight times the energy of a site with an average wind speed of 7.5 mph. This means that the location of the turbine, on your property and in terms of height, is absolutely essential to getting the most power out of your system.

-

A residential wind system can cost less than $1,000 for a very small turbine or over $50,000 for a system that can fully power your home. Typical installed costs can range from $15,000 - $20,000 for a 1.8-kilowatt turbine that may power a lightbulb or two to $50,000 - $100,000 for a 10- kilowatt turbine that can power your home. Bear in mind that you do get what you pay for, therefore an inexpensive turbine will not produce significant amounts of electricity. The amount of power you get depends on your resource. Elements of an installed system include the cost of the turbine, the cost of the tower, and the cost of the installation. Do not skimp on the tower height as the taller the tower, the better the resource and the more electricity you will produce.

Most of the commercial-scale turbines installed in Pennsylvania are 1.5 to 2.5 MW in size and cost roughly $3 to 5 million to purchase, construct and install. How a project will be financed, owned, and operated can be just as critical to success as wind resource. Contact us for guidance.

-

How much money you save depends on how much electricity you produce and what your cost of electricity is. You wouldn’t fill a bucket with water if the bucket were full of holes. Before you invest in a renewable energy system, you should make your home or business as efficient as possible.

Efficiency means getting the same benefit with less electricity. For example, a laptop computer may use less than half of the electricity as a desktop computer. A LED bulb uses less energy and lasts longer than an incandescent bulb.

Conservation refers to your actions, what we call the COPs - cheap, obvious, and profitable, such as turning things off when not in use, unplugging devices that use energy even when they are not on, and lowering your thermostat and water heater when you’re not around. These changes alone can save you 10% - 20% on your energy bills!

The experts at Home Power magazine claim that every dollar spent on efficiency and conservation will save you three to five dollars on your solar, wind or hydro system. So, if you spend $200 to do an extreme green makeover of your home or business—that’s $1,000 you saved on your renewable energy system (because now it does not have to be as large since your energy demand decreased).

-

For small wind projects, begin by assessing your wind resource by using a wind map. Typically, on-site data collection is not necessary and cost prohibitive. Consult with an installer and have them review your property for any potentially problematic flaws. Check with your utility to ensure you can connect to the grid and with your municipality to ensure there are no policies restricting the installation of a system. A knowledgeable installer should be able to help you with these and other important tasks as well as assisting in system design and financing. You can then proceed to construction. The allotted time will vary, but on average may take a few months to design a layout and install.

Larger projects may follow a similar process, such as outlined below, although it can easily take 4 - 6 years to go from concept to completion.

- Determine Resource - Wind Map Analysis, Site Visit, On-Site Data Collection and Analysis

- Investment Analysis

- Permitting

- Power Purchase Agreement

- Financing

- Infrastructure Procurement (Turbines, Substation, etc.)

- Construction

- Operations and Maintenance

-

Beginning in the mid-2000s, investor-owned utilities in Pennsylvania were required to begin accepting electricity generated by individual consumers. Alternative Energy Credits may also be available. Before beginning a project, be it wind or otherwise, be sure to inform your utility so that you can plan accordingly for any requirements you may need to meet to connect your system to the grid.

Learn more: DSIRE: Net Metering

Alternative Energy Portfolio Standards

-

It is recommended that you compare multiple companies before you make a decision. Make sure to base your decision on equal offerings (for example: the same style of turbine at the same height, kW rating, etc.). Visit our starting a renewable project page for tips on this.

-

See our starting a renewable energy project page for financial resources.

-

Generally speaking, for a small wind turbine, you need at least a 1/2 acre of open land where you can mount the turbine on a tower (though this depends on local zoning and regulations).

Larger turbines will need between one and several acres of open land during installation. Once complete, the space requirement will typically shrink, allowing activities such as farming to occur around the turbine. A wind farm, consisting of many wind turbines, may span hundreds or thousands of acres

-

A typical home in the United States uses approximately 11,000 kilowatt-hours (kWh) of electricity a year. The size of your turbine depends on your resource, your energy consumption, and how much power you want to produce. Invest in energy efficiency first and never skimp on the height of the tower.

-

The amount of electricity you want to produce and space requirements are just a few of many factors that should factor into finding the optimal turbine for your site.

The Small Wind Certification Council has established criteria to test small wind turbines in a standardized form and then report the results on an "apples-to-apples" basis. Annual energy, sound, and power ratings are provided for each certified model.

Whether enrolled in the SWCC or not, it is important to conduct a thorough review of each turbine and manufacturer you are considering before making a decision, as the small wind industry continues to change and evolve.

Links: HomePower: Is Wind Electricity Right for You?

Mother Earth News: Wind Power: Are Vertical Axis Turbines Better?

-

This varies by township. Contact your local township office and ask if your township has a residential and/or utility wind ordinance. See an example PA Model Ordinance. Also see a catalog of wind energy ordinances from across the country. If no ordinance is established, DOE has developed a Wind Energy Guide for County Commissioners.

-

Check your instruction manual for a maintenance schedule and guidelines. It is important to monitor the health of your wind turbine on a continual basis. If you hear or see something abnormal, it is important to address the problem to limit damage to your machine. Remember to use extreme caution around the turbine and to leave tasks such as climbing and electrical work to professionals. Utility-scale wind turbines require maintenance on a regular basis. Wind farms typically have a dedicated staff to complete this task.

In Pennsylvania, the best wind resource is typically found at higher elevations and along the shore of Lake Erie. For a small wind project to be successful, a site's annual average wind speed should be no less than 10 - 12 miles per hour and the turbine should be positioned at least 30 feet above any obstacles that are within 500 feet. For larger turbines, a 6.5 + meters per second wind speed is typically needed to support a viable project. You can put a wind turbine just about anywhere and it will generate electricity. . .the question is how much and if the result satisfies your financial goals and other desired results. To help assess your wind resource, see our wind maps above.

Wind speed is a critical feature of the wind resource because the available energy in the wind is proportional to the cube of the wind speed. This means that by doubling the wind speed we do not double the power in the wind but get eight times the power. So, a site with an average wind speed of 15 mph has the potential to contain eight times the energy of a site with an average wind speed of 7.5 mph. This means that the location of the turbine, on your property and in terms of height, is absolutely essential to getting the most power out of your system.

A residential wind system can cost less than $1,000 for a very small turbine or over $50,000 for a system that can fully power your home. Typical installed costs can range from $15,000 - $20,000 for a 1.8-kilowatt turbine that may power a lightbulb or two to $50,000 - $100,000 for a 10- kilowatt turbine that can power your home. Bear in mind that you do get what you pay for, therefore an inexpensive turbine will not produce significant amounts of electricity. The amount of power you get depends on your resource. Elements of an installed system include the cost of the turbine, the cost of the tower, and the cost of the installation. Do not skimp on the tower height as the taller the tower, the better the resource and the more electricity you will produce.

Most of the commercial-scale turbines installed in Pennsylvania are 1.5 to 2.5 MW in size and cost roughly $3 to 5 million to purchase, construct and install. How a project will be financed, owned, and operated can be just as critical to success as wind resource. Contact us for guidance.

How much money you save depends on how much electricity you produce and what your cost of electricity is. You wouldn’t fill a bucket with water if the bucket were full of holes. Before you invest in a renewable energy system, you should make your home or business as efficient as possible.

Efficiency means getting the same benefit with less electricity. For example, a laptop computer may use less than half of the electricity as a desktop computer. A LED bulb uses less energy and lasts longer than an incandescent bulb.

Conservation refers to your actions, what we call the COPs - cheap, obvious, and profitable, such as turning things off when not in use, unplugging devices that use energy even when they are not on, and lowering your thermostat and water heater when you’re not around. These changes alone can save you 10% - 20% on your energy bills!

The experts at Home Power magazine claim that every dollar spent on efficiency and conservation will save you three to five dollars on your solar, wind or hydro system. So, if you spend $200 to do an extreme green makeover of your home or business—that’s $1,000 you saved on your renewable energy system (because now it does not have to be as large since your energy demand decreased).

For small wind projects, begin by assessing your wind resource by using a wind map. Typically, on-site data collection is not necessary and cost prohibitive. Consult with an installer and have them review your property for any potentially problematic flaws. Check with your utility to ensure you can connect to the grid and with your municipality to ensure there are no policies restricting the installation of a system. A knowledgeable installer should be able to help you with these and other important tasks as well as assisting in system design and financing. You can then proceed to construction. The allotted time will vary, but on average may take a few months to design a layout and install.

Larger projects may follow a similar process, such as outlined below, although it can easily take 4 - 6 years to go from concept to completion.

- Determine Resource - Wind Map Analysis, Site Visit, On-Site Data Collection and Analysis

- Investment Analysis

- Permitting

- Power Purchase Agreement

- Financing

- Infrastructure Procurement (Turbines, Substation, etc.)

- Construction

- Operations and Maintenance

Beginning in the mid-2000s, investor-owned utilities in Pennsylvania were required to begin accepting electricity generated by individual consumers. Alternative Energy Credits may also be available. Before beginning a project, be it wind or otherwise, be sure to inform your utility so that you can plan accordingly for any requirements you may need to meet to connect your system to the grid.

Learn more: DSIRE: Net Metering

Alternative Energy Portfolio Standards

It is recommended that you compare multiple companies before you make a decision. Make sure to base your decision on equal offerings (for example: the same style of turbine at the same height, kW rating, etc.). Visit our starting a renewable project page for tips on this.

See our starting a renewable energy project page for financial resources.

Generally speaking, for a small wind turbine, you need at least a 1/2 acre of open land where you can mount the turbine on a tower (though this depends on local zoning and regulations).

Larger turbines will need between one and several acres of open land during installation. Once complete, the space requirement will typically shrink, allowing activities such as farming to occur around the turbine. A wind farm, consisting of many wind turbines, may span hundreds or thousands of acres

A typical home in the United States uses approximately 11,000 kilowatt-hours (kWh) of electricity a year. The size of your turbine depends on your resource, your energy consumption, and how much power you want to produce. Invest in energy efficiency first and never skimp on the height of the tower.

The amount of electricity you want to produce and space requirements are just a few of many factors that should factor into finding the optimal turbine for your site.

The Small Wind Certification Council has established criteria to test small wind turbines in a standardized form and then report the results on an "apples-to-apples" basis. Annual energy, sound, and power ratings are provided for each certified model.

Whether enrolled in the SWCC or not, it is important to conduct a thorough review of each turbine and manufacturer you are considering before making a decision, as the small wind industry continues to change and evolve.

Links: HomePower: Is Wind Electricity Right for You?

Mother Earth News: Wind Power: Are Vertical Axis Turbines Better?

This varies by township. Contact your local township office and ask if your township has a residential and/or utility wind ordinance. See an example PA Model Ordinance. Also see a catalog of wind energy ordinances from across the country. If no ordinance is established, DOE has developed a Wind Energy Guide for County Commissioners.

Check your instruction manual for a maintenance schedule and guidelines. It is important to monitor the health of your wind turbine on a continual basis. If you hear or see something abnormal, it is important to address the problem to limit damage to your machine. Remember to use extreme caution around the turbine and to leave tasks such as climbing and electrical work to professionals. Utility-scale wind turbines require maintenance on a regular basis. Wind farms typically have a dedicated staff to complete this task.

Wind Technology

-

A windmill is a device used to pump water or grind grain. A wind turbine generates electricity, although these machines are commonly referred to as windmills as well.

-

Turbine towers can be over 300 feet tall and have blades more than 150 feet long. This means that when a blade tip reaches its peak height, it can be 450 feet, or more, in the air.

As technology has advanced over time, engineers have been able to develop larger turbines, allowing more wind to be harnessed while using fewer turbines. In 2019, the Big Level Wind Farm was constructed in Potter County, PA, with the tips of the blades on some of the turbines reaching more than 650 feet into the air - the tallest in North America - at that time, according to a Potter Leader-Enterprise article.

-

A small wind turbine may generate enough electricity to power anywhere from a light bulb up to several houses, depending on the turbine’s size and the speed of the wind. A utility-scale turbine can power hundreds of homes when operating in optimal wind speeds. For example, EverPower, developer of the Patton Wind Farm in Cambria County, stated that the fifteen 2.0 MW turbines at the project generate "enough electricity to power approximately 7,000 homes annually."

-

The electricity produced by a wind turbine may be used on-site or sent to the grid.

In most situations, such as at wind farms, power produced by a turbine is sent to the power grid. The power grid is a set of electrical transmission and distribution lines that connect electricity generators and consumers.

It works like this: First, the electricity produced from a wind power plant goes to a local substation. From the substation, the electrons flow to where they are needed. If there is no demand locally, they continue on down the line. If you live close to a wind farm, there is a very good chance that the electrons produced from the wind turbines end up in your home. However, electrons cannot be traced or followed, which makes it very difficult to say for sure from which power plant they came. If you live in PA, it's likely to be a conglomerate of energy sources, including coal, nuclear, natural gas, wind and others. If you see a sign that advertises a home or business is 100% powered by wind energy, it is usually referring to the "Renewable Energy Credits" they purchased and not the physical electrons flowing into their appliances.

It is possible to use wind power on-site, however, in order to have power when the wind is not blowing, a user must rely on batteries, have another energy source producing power, or be connected to the grid.

-

A few reasons a wind turbine might not be spinning are if the wind speed is not strong enough, if maintenance is being performed on the machine, if there is not a need for electricity (this occurs when the turbine could be producing electricity, but the gird does not need it - a process called curtailment), or if it is a migration time for birds or bats and the turbine is in a flyway.

A windmill is a device used to pump water or grind grain. A wind turbine generates electricity, although these machines are commonly referred to as windmills as well.

Turbine towers can be over 300 feet tall and have blades more than 150 feet long. This means that when a blade tip reaches its peak height, it can be 450 feet, or more, in the air.

As technology has advanced over time, engineers have been able to develop larger turbines, allowing more wind to be harnessed while using fewer turbines. In 2019, the Big Level Wind Farm was constructed in Potter County, PA, with the tips of the blades on some of the turbines reaching more than 650 feet into the air - the tallest in North America - at that time, according to a Potter Leader-Enterprise article.

A small wind turbine may generate enough electricity to power anywhere from a light bulb up to several houses, depending on the turbine’s size and the speed of the wind. A utility-scale turbine can power hundreds of homes when operating in optimal wind speeds. For example, EverPower, developer of the Patton Wind Farm in Cambria County, stated that the fifteen 2.0 MW turbines at the project generate "enough electricity to power approximately 7,000 homes annually."

The electricity produced by a wind turbine may be used on-site or sent to the grid.

In most situations, such as at wind farms, power produced by a turbine is sent to the power grid. The power grid is a set of electrical transmission and distribution lines that connect electricity generators and consumers.

It works like this: First, the electricity produced from a wind power plant goes to a local substation. From the substation, the electrons flow to where they are needed. If there is no demand locally, they continue on down the line. If you live close to a wind farm, there is a very good chance that the electrons produced from the wind turbines end up in your home. However, electrons cannot be traced or followed, which makes it very difficult to say for sure from which power plant they came. If you live in PA, it's likely to be a conglomerate of energy sources, including coal, nuclear, natural gas, wind and others. If you see a sign that advertises a home or business is 100% powered by wind energy, it is usually referring to the "Renewable Energy Credits" they purchased and not the physical electrons flowing into their appliances.

It is possible to use wind power on-site, however, in order to have power when the wind is not blowing, a user must rely on batteries, have another energy source producing power, or be connected to the grid.

A few reasons a wind turbine might not be spinning are if the wind speed is not strong enough, if maintenance is being performed on the machine, if there is not a need for electricity (this occurs when the turbine could be producing electricity, but the gird does not need it - a process called curtailment), or if it is a migration time for birds or bats and the turbine is in a flyway.

Wind Turbine and Their Environments

-

A study evaluating the impact of wind turbines on “residential property transactions from 2005 to 2020,” was conducted by the Lawerence Berkeley National Laboratory in 2023. For properties located within one mile of a wind farm, the report found “that property value effects were evident beginning after the project was announced and continuing through the construction period, but abated three to five years after operation began. These effects were concentrated in counties with higher population densities and were not evident in rural areas,” according to the U.S. Department of Energy. The study included 428 wind projects in 34 states, including Pennsylvania.

-

Wind turbines, like all electricity sources, can have both positive and negative impacts on the environment. On the positive side, wind turbines emit no greenhouse gases, require no mining for fuel, and use negligible amounts of water. They have a small footprint and the land around them can still be used for farming or forests. On the negative side, turbines and their access roads can fragment habitat. Unless carefully constructed and maintained, the roads can lead to erosion. The turbines must be properly sited to avoid avian migratory paths and bats. Turbines are also sometimes noted for producing noise and causing a shadow flicker. Some people enjoy seeing wind turbines, viewing them as kinetic sculpture and some find them aesthetically unpleasing.

Learn more: Environmental Impacts and Siting of Wind Projects

The U.S. Fish and Wildlife Service has established voluntary land-based wind energy guidelines for wind energy projects. The Guidelines use a 'tiered approach' for assessing potential adverse effects to species of concern and their habitats," according to the guideline's executive summary. The guidelines provide an outline for understanding the characteristics of a site and monitoring the area before, during, and after construction of a wind farm. See the US. Fish and Wildlife Service's webpage for information about interactions between wind and wildlife. The Pennsylvania Game Commission has developed a Wind Energy Voluntary Cooperative Agreement with wind developers. They try to monitor, understand, and reduce impacts of the development of wind in the Commonwealth. Information related to the agreement and reports are available at the PGC's website. Pennsylvania Natural Heritage Program provides “information on the location and status of important ecological resources.” The program’s website includes a county inventory interactive map and an environmental review tool.

-

- Before a wind turbine can be installed, an obstruction evaluation/ airport airspace analysis (OE/AAA) may need to be completed by the Federal Aviation Administration. Structures over 200 feet above ground level and those within close proximity to an airport, among others, must be reviewed.

Learn more: FAA Wind Turbine FAQs

-

Wind turbines in close proximity to a radar unit may interfere with an accurate reading, whether it be for defense purposes or weather monitoring. When the National Weather Service's NEXRAD dopplar radar detects motion (such as rain), it concludes that it is precipitation. The radar cannot differentiate between precipitation and a wind turbine, so a weather map may appear to have rain at a wind farm when it is actually sunny. In Pennsylvania you may notice this effect on weather maps in Cambria and Blair Counties.

Learn more: How Rotating Wind Turbine Blades Impact The Nexrad Doppler Weather Radar

A study evaluating the impact of wind turbines on “residential property transactions from 2005 to 2020,” was conducted by the Lawerence Berkeley National Laboratory in 2023. For properties located within one mile of a wind farm, the report found “that property value effects were evident beginning after the project was announced and continuing through the construction period, but abated three to five years after operation began. These effects were concentrated in counties with higher population densities and were not evident in rural areas,” according to the U.S. Department of Energy. The study included 428 wind projects in 34 states, including Pennsylvania.

Wind turbines, like all electricity sources, can have both positive and negative impacts on the environment. On the positive side, wind turbines emit no greenhouse gases, require no mining for fuel, and use negligible amounts of water. They have a small footprint and the land around them can still be used for farming or forests. On the negative side, turbines and their access roads can fragment habitat. Unless carefully constructed and maintained, the roads can lead to erosion. The turbines must be properly sited to avoid avian migratory paths and bats. Turbines are also sometimes noted for producing noise and causing a shadow flicker. Some people enjoy seeing wind turbines, viewing them as kinetic sculpture and some find them aesthetically unpleasing.

Learn more: Environmental Impacts and Siting of Wind Projects

The U.S. Fish and Wildlife Service has established voluntary land-based wind energy guidelines for wind energy projects. The Guidelines use a 'tiered approach' for assessing potential adverse effects to species of concern and their habitats," according to the guideline's executive summary. The guidelines provide an outline for understanding the characteristics of a site and monitoring the area before, during, and after construction of a wind farm. See the US. Fish and Wildlife Service's webpage for information about interactions between wind and wildlife. The Pennsylvania Game Commission has developed a Wind Energy Voluntary Cooperative Agreement with wind developers. They try to monitor, understand, and reduce impacts of the development of wind in the Commonwealth. Information related to the agreement and reports are available at the PGC's website. Pennsylvania Natural Heritage Program provides “information on the location and status of important ecological resources.” The program’s website includes a county inventory interactive map and an environmental review tool.

- Before a wind turbine can be installed, an obstruction evaluation/ airport airspace analysis (OE/AAA) may need to be completed by the Federal Aviation Administration. Structures over 200 feet above ground level and those within close proximity to an airport, among others, must be reviewed.

Learn more: FAA Wind Turbine FAQs

Wind turbines in close proximity to a radar unit may interfere with an accurate reading, whether it be for defense purposes or weather monitoring. When the National Weather Service's NEXRAD dopplar radar detects motion (such as rain), it concludes that it is precipitation. The radar cannot differentiate between precipitation and a wind turbine, so a weather map may appear to have rain at a wind farm when it is actually sunny. In Pennsylvania you may notice this effect on weather maps in Cambria and Blair Counties.

Learn more: How Rotating Wind Turbine Blades Impact The Nexrad Doppler Weather Radar

Wind History & Statistics

-

According to the Department of Energy, people may have been using wind power since 5,000 B.C. for sailing. By 200 B.C., it is believed that windmills were being used to pump water and grind grain. It allowed people to sail the oceans and explore the world. In the late 1800s, millions of windmills could be found in the United States pumping water. Even here in Pennsylvania, windmills were a common sight up to the 1920s and 30s and there were nearly a dozen manufacturers producing windmill models at one time or another. The Rural Electrification Act of 1936 brought electricity to rural places, limiting the use of wind power in mid-century. Commercial wind farms have developed over the past fifty years and can now produce large amounts of power.

-

The first wind farm constructed in Pennsylvania was the Green Mountain Wind Energy Center in Garrett, Somerset County. It began operating in May of 2000. It was deactivated in December 2015 and removed in November to December 2016.

-

As of September 2024, there were over 700 utility scale wind turbines in the state of Pennsylvania. The Commonwealth exceeded 1,000 MW of installed capacity in 2012. See our wind farms page for additional information.

-

The American Wind Energy Association maintains a list of wind energy facts, including the number of U.S. wind turbines.

According to the Department of Energy, people may have been using wind power since 5,000 B.C. for sailing. By 200 B.C., it is believed that windmills were being used to pump water and grind grain. It allowed people to sail the oceans and explore the world. In the late 1800s, millions of windmills could be found in the United States pumping water. Even here in Pennsylvania, windmills were a common sight up to the 1920s and 30s and there were nearly a dozen manufacturers producing windmill models at one time or another. The Rural Electrification Act of 1936 brought electricity to rural places, limiting the use of wind power in mid-century. Commercial wind farms have developed over the past fifty years and can now produce large amounts of power.

The first wind farm constructed in Pennsylvania was the Green Mountain Wind Energy Center in Garrett, Somerset County. It began operating in May of 2000. It was deactivated in December 2015 and removed in November to December 2016.

As of September 2024, there were over 700 utility scale wind turbines in the state of Pennsylvania. The Commonwealth exceeded 1,000 MW of installed capacity in 2012. See our wind farms page for additional information.

The American Wind Energy Association maintains a list of wind energy facts, including the number of U.S. wind turbines.

Disclaimer

Use of the Saint Francis University Renewable Energy Center/Institute for Energy's materials (including wind maps, data, and other content) is solely at the risk of the user. The Saint Francis University Renewable Energy Center/Institute for Energy and its funders may not be held liable for any loss, damage or other consequence resulting from the use of the maps and/or data contained on this website, our wind explorer, or through other interactions with the REC/IFE. Remember to take proper safety precautions when pursing any project.